Special Council Meeting

Minutes

Wednesday 25 June 2014

Commencing at 5.00pm

Nandaly Community Hall

5 Messines Street

Nandaly

John Hicks

Acting Chief Executive Officer

Buloke Shire Council

Special Council Meeting

Minutes

Wednesday 25 June 2014

Commencing at 5.00pm

Nandaly Community Hall

5 Messines Street

Nandaly

John Hicks

Acting Chief Executive Officer

Buloke Shire Council

Minutes of the Special Meeting held on Wednesday, 25 June 2014 commencing at 5.00pm in the Nandaly Community Hall, 5 Messines Street, Nandaly

PRESENT

CHAIRPERSON:

Cr Reid Mather Mallee Ward

COUNCILLORS:

Cr Ellen White Mallee Ward

Cr David Pollard Lower Avoca Ward

Cr Stuart McLean Lower Avoca Ward

Cr Graeme Milne Mount Jeffcott Ward

Cr Leo Tellefson Mount Jeffcott Ward

Cr Gail Sharp Mount Jeffcott Ward

OFFICERS:

Mr John Hicks Acting Chief Executive Officer

Ms Gaynor Doreian Director Corporate and Community Services

Mr Anthony Judd Director Works and Technical Services

Mr Tom O’Reilly Manager Finance

AGENDA

1. COUNCIL prayer AND WELCOME

The Mayor Cr Reid Mather read the Council Prayer and welcomed members of the gallery.

We acknowledge the traditional owners of the land on which we are meeting. We pay our respects to their Elders and to the Elders from other communities who maybe here today.

2. RECEIPT OF APOLOGIES

Nil.

3. REQUESTS FOR LEAVE OF ABSENCE

Nil.

4. DECLARATION of PECUNIARY AND conflictS of interest

There were no declarations of interest.

|

Council resolve to amend the Order of Business for this Special Meeting 25 June 2014, in order to consider a Late Report, Petition in Regard to the Buloke Shire Council Budget 2014 – 2015, to be addressed prior to considering Item 5.1.

Seconded: Cr David Pollard Carried. |

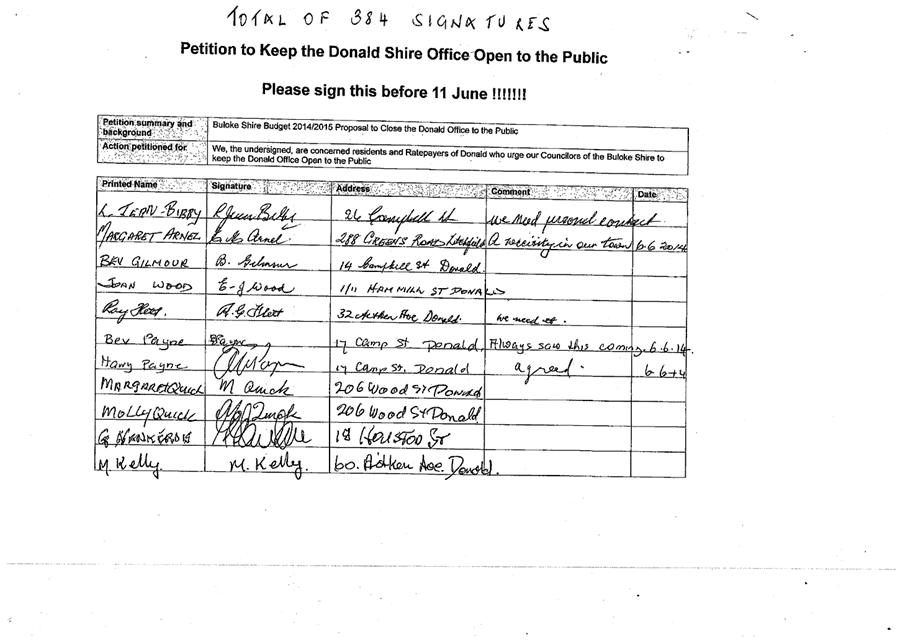

Petition in regard to Buloke Shire Council Budget 2014-15

5.1 Adoption of Budget for Municipal Year Ending 30 June 2015

NEXT MEETING

The next Ordinary Meeting of Council will be held in Wycheproof Supper Room, 367 Broadway, Wycheproof on Wednesday, 9 July 2014 at 7.00pm.

JOHN HICKS

ACTING CHIEF EXECUTIVE OFFICER

5. Item

Petition in regard to Buloke Shire Council Budget 2014-15

Author’s Title: Acting Chief Executive Officer

Department: Office of the CEO File No: FM/05/02

|

1 ViewPetition - Keep the Donald Shire Office Open to the Public |

Relevance to Council Plan 2013 - 2017

Objective: An organisation that is responsibly governed with a strong emphasis on sustainable financial and risk management.

Strategy: Ensuring Council is well governed and its finances and risks are managed sustainably and responsibly.

Priority: Review and renew the Council’s financial plans to improve financial sustainability as measured by indicators of local government financial sustainability developed by the Victorian Auditor-General’s Office.

|

That Council consider the petition requesting Council “keep the Donald office open to the public” received at the last Special Meeting of 18 June 2014 as part of its decisions on the 2014-2015 Draft Budget.

Seconded: Cr Leo Tellefson Carried. |

1. Executive Summary

A Petition supported by 384 signatures was received by Council on 11 June 2014. The petition referenced the Buloke Shire Budget 2014/2015, requested “Council keep the Donald Office open to the public” and was tabled at the 18 June 2014 Council Special Meeting.

2. Discussion

The petition arose at the same time as Council exhibited its draft budget for public comment. The draft budget advocates the closure of face-to-face customer services at four Council offices including Donald.

3. Financial Implications

In the draft budget the closure of face-to-face customer services at four Council offices is expected to realise a cost saving in 2015-2016 of $380,000.

4. Community Consultation

Community Consultation on the draft budget was undertaken at 10 Town meetings and with submissions received at last week’s Special Council Meeting.

5. Internal Consultation

Extensive internal consultation was undertaken in the preparation of the draft budget including a Service Review to identify cost savings.

6. Legislative/ Policy Implications

Nil.

7. Environmental Sustainability

Nil.

8. Conflict of Interest Considerations

There are no conflict of interest considerations associated with this report.

9. Conclusion

Council can consider the petition as part of its decisions on the 2014-2015 draft budget.

Buloke Shire Council Special Meeting Minutes Wednesday, 25 June 2014

Petition in regard to Buloke Shire Council Budget 2014-15

Attachment 1 Petition - Keep the Donald Shire Office Open to the Public

5.1 Adoption of Budget for Municipal Year Ending 30 June 2015

Author’s Title: Acting Manager Finance

Department: Finance File No: Bud1

|

1 ViewDraft 2014-15 Budget for Adoption |

Relevance to Council Plan 2013 - 2017

Objective: An organisation that is responsibly governed with a strong emphasis on sustainable financial and risk management.

Strategy: Ensuring Council is well governed and its finances and risks are managed sustainably and responsibly.

Priority: Review and renew the Council’s financial plans to improve financial sustainability as measured by indicators of local government financial sustainability developed by the Victorian Auditor-General’s Office.

|

That Council having considered all submissions received in accordance with Section 223 of the Local Government Act 1989 (the Act) and having complied with the requirements of the Act: 1. Adopts the amended 2014/15 Proposed Budget as the final Adopted Annual Budget of Council for the 2014/15 financial year 2. Authorises the Acting Chief Executive Officer to give public notice of the decision to adopt the Annual Budget and submit a copy to the Minister for Local Government, in accordance with Section 130 of the Act 3. Notifies in writing the persons who have made submissions in accordance with Section 223 of the Act, of the Council’s decision 4. A general rate be declared for the period commencing on 1 July 2014 and concluding on 30 June 2015 5. Declare that the general rate be raised by the application of differential rates 6. Declare a total amount of $11,453,120 as the amount Council intends to raise by General Rates and annual Service Charges, which is calculated as follows: · Section 158:General Rates $9,514,000 · Section 159:Municipal Charge $657,000 · Section 158:Kerbside Garbage & Recycling Collection Annual Service Charge $1,282,120 7. Declare the Municipal Charge for 2014/15 at $150 for each rateable assessment in respect of which a Municipal Charge may be levied 8. Declare the annual Service Charge for Kerbside Garbage & Recycling Collection at $380 9. Provide for an early full rate payment discount of 1.5% on rates and charges to be granted, if full payment (including any arrears and interest) is received on or before Friday 26 September 2014. (The discount to exclude the Fire Services Property Levy). 10. Make copies of the 2014/15 Adopted Budget available at Council offices and on the Council website.

Seconded: Cr Stuart McLean AMENDED MOTION PUT:

The closure of customer service at offices, except for Wycheproof, be removed from the budget and other processes be considered to make the savings.

Moved: Cr LEO TELLEFSON

Seconded: Cr GAIL SHARP

Cr Milne declared a Conflict of Interest.

Cr Milne left the Council Chamber at 5.33pm.

AMENDED MOTION PUT AMENDED MOTION - lost.

Cr Milne returned to the Council Chamber at 5.39pm.

The original motion was then put and carried

Cr Milne requested a division.

Cr Reid Mather - FOR Cr Ellen White - FOR Cr David Pollard - FOR Cr Stuart McLean - FOR Cr Graeme Milne - AGAINST Cr Leo Tellefson - FOR Cr Gail Sharp - FOR

|

1. Executive Summary

In relation to the 2014/15 Proposed Budget, Council having considered public submissions and other information contained in this report must resolve whether to:

a) adopt the 2014/15 Budget following public notice and inspection in accordance with the Act and

b) declare the amount which the Council intends to raise by rates and charges

This report recommends that Council adopt the amended 2014/15 Proposed Budget attached to this report, as the final Adopted Annual Budget of Council for the 2014/15 financial year.

2. Discussion

Under the provisions of the Act, Council is required to prepare and adopt an annual budget for each financial year. The budget is required to include certain information about the rates and charges the council intends to levy, as well as a range of other information required by the regulations which support the Act e.g. the capital works program to be undertaken and the human resources required.

Importantly, the Budget document contains detailed financial performance indicators which provide a useful analysis of the Council’s financial position and performance.

3. Revisions to the Proposed Budget

Following the presentation of the Proposed Budget at the Ordinary Council meeting of 14 May 2014, the Council has become aware of new information which impacts on the Budget. This new information has been incorporated into the Proposed Budget resulting in the following amendments:

a) Federal Budget Changes:

· The Commonwealth Government intends to pause the indexation of the financial assistance grants for the three years to the end of 2016/17. This impact has resulted in a total combined loss of $579,849 of grants income being removed from the Proposed Budget for the years 2014/15 to 2017/18.

· The Commonwealth Government has indicated that it does not intend to bring forward any advance payments as has occurred in previous years. The impact has resulted in $1,322,431 of grants income being removed from the 2013/14 Forecast Actual.

b) Capital Works Carried Forward From 2013/14

· The Proposed Budget has been amended to reflect the capital works program carried forwards expenditure from 2013/14, increasing from $1,027,600 to $1,883,600 due to timing delays in finalising projects before 30 June 2014. These projects have already commenced and will now be completed in the 2014/15 financial year.

c) Sundry Debtor Flood Works Income

· The Proposed Budget provided for an estimated $800,000 of income resulting from Council staff undertaking flood recovery road work repairs on behalf of the external contractor for the flood recovery works. The total forecast income for 2013/14 has been revised down by $100,000.

d) Flood Grants Income

· Council has been advised to expect receipt of an additional $400,000 of Capital Flood Grants monies before 30 June 2014. The Proposed Budget has been amended to reflect this timing difference with the Forecast Actual 2013/14 being increased by $400,000 and the 2014/15 Budget decreased by the same amount; overall a neutral impact.

e) Loan Borrowings

· The Budget provides for an interest only loan of $7M over 5 years. Advice has recently been received advising the indicative loan interest rate will be 4.8% fixed. This positive reduction in the indicative loan interest rate reflects an additional saving of $20,000 per annum in the 2014/15 Budget and Forecast years.

4. Financial Implications

The annual budget adoption process is a formal process required under Section 127 (1) of the Act and includes the current and future financial implications of Council’s operations and capital expenditure requirements. The adopted 2014/15 Budget will provide an overarching financial framework for the Council to implement for the forthcoming year.

5. Community Consultation

The Proposed Budget was presented at the Ordinary Council meeting of Wednesday 14th May 2014. The Proposed Budget was then publicly advertised in the Melbourne Age and three local newspapers seeking submissions from interested parties in accordance with Section 223 of the Act.

The Proposed Budget was available for inspection at the five Council district offices and also on the Council’s website www.buloke.vic.gov.au .

Public Budget Information sessions were held in ten (10) Shire of Buloke townships on 26 May and 27 May 2014.

All written submissions (nine in total including a petition with 384 signatures) received in accordance with Section 223 of the Act, were received at a Special Council meeting held on Wednesday 18th June 2014. Several interested parties took the opportunity to provide a verbal presentation to their submission at the meeting for further Council consideration.

6. Internal Consultation

The Budget has been prepared by the Acting Finance Manager with extensive input from Councillors, the Senior Management team and Budget Managers.

7. Legislative / Policy Implications

Council has a statutory responsibility to prepare and adopt a Budget In accordance with the Local Government Act 1989 and Local Government (Planning and Reporting) Regulations 2014.

The Council must adopt its budget and forward a copy to the Minister for Local Government by 31 August 2014.

8. Environmental Sustainability

There are no environmental considerations arising from this report.

9. Conflict of Interest Considerations

Section 79C(2) of the Local Government Act indicates that if a budget or revised budget to be approved by Council includes funding for a matter of which a Councillor has a Conflict of Interest, the Councillor is taken not to have a Conflict of Interest for the purposes of approving the budget or revised budget if:

- The Council approved the matter and proposed funding previously; and

- The Councillor disclosed the nature of the Conflict of Interest when the decision in respect of the funding was originally considered and made.

10. Conclusion

Council has complied with all of the relevant requirements of the Local Government Act 1989 relating to the preparation, presentation and adoption of the 2014/15 Budget.

Buloke Shire Council Special Meeting Minutes Wednesday, 25 June 2014

5.1.1 Adoption of Budget for Municipal Year Ending 30 June 2015

Attachment 1 Draft 2014-15 Budget for Adoption

DRAFT

BULOKE SHIRE COUNCIL

Annual Budget

2014 – 2015

Presented to Council on 25th June 2014 for adoption

Buloke Shire Council Special Meeting Wednesday, 25 June 2014

5.1.1 Adoption of Budget for Municipal Year Ending 30 June 2015

Attachment 1 Draft 2014-15 Budget for Adoption

|

Contents |

Page |

|

|

|

|

Mayor’s introduction |

3 |

|

Chief Executive Officer’s summary |

5 |

|

Budget processes |

8 |

|

Overview |

|

|

1. Linkage to the Council Plan |

9 |

|

2. Services, initiatives and service performance indicators |

12 |

|

3. Budget influences |

23 |

|

Budget analysis |

|

|

26 |

|

|

33 |

|

|

36 |

|

|

39 |

|

|

Long term strategies |

|

|

8. Strategic resource plan and financial performance indicators |

41 |

|

45 |

|

|

10. Other Strategies |

48 |

|

Appendices |

|

|

51 |

|

|

B Rates and charges |

58 |

|

63 |

|

|

D Fees and charges schedule |

69 |

|

E Service Review Outcomes |

79 |

Buloke Shire Council Special Meeting Wednesday, 25 June 2014

5.1.1 Adoption of Budget for Municipal Year Ending 30 June 2015

Attachment 1 Draft 2014-15 Budget for Adoption

Mayor’s introduction

It gives me great pleasure to present this Budget to the community of Buloke.

The budget sets a new direction for Buloke Shire Council and puts the framework together to secure the long term sustainability of the Shire.

The Buloke Community and Council have been rebuilding the community assets after the devastating floods in 2010 and 2011. This has seen over $42 million spent on our road network alone with these works being completed in June 2014. Council’s emphasis now needs to be on securing long term financial sustainability.

To this end, Council has considered all of the services that are provided and recognise that strategic decisions on service provision are required to have an impact on financial sustainability. In reviewing services particular emphasis has been based around continuing to support community groups who provide valuable support and services to the community.

These groups rely on extensive volunteer support and are often the life blood of small communities. This budget continues to support these groups and removes much of the red tape for these organisations by committing to funding support without the need for an extensive application process. Council has also considered services that have previously received external funding and these services have been reduced to reflect current funding allocations.

The 2014/15 Budget proposes direct operating expenditure reduction of $1.3 million and foreshadows further ongoing reductions of $3.4 million annually. We will increase rates by 6.0 percent in the 2014/15 financial year and the kerbside garbage and recycling service charge will increase to $380 per service to ensure full cost recovery for the service provided. The Budget proposes a borrowing program of $7.0mill in the 2014/15 financial year and a total Capital Works program of $7.78 million, with Council substantially relying on Grant Funds to deliver the program.

To achieve these reductions in operating expenditure Council will need to change service levels. It is recognised that changes in service provision will take time to implement. Further consultation with Staff and the Community is required to ensure the changes are implemented in a manner which minimises the impacts and Council is able to continue its service delivery obligations.

It is further recognised that additional savings are required and Council has requested management to continue to find improvements and efficiencies in services across all areas of Council’s operations.

The key initiatives in the Budget are:

· Funding for three key flood mitigation projects that were prioritised out of the Charlton and Donald Flood and Drainage Management Plans. This includes $225,000 to develop full functional plans, specifications and costings for the Charlton town ring levee bank. $500,000 for increasing the size of the culverts over Gower Creek on the Charlton-St Arnaud Road. For Donald, $925,500 has been allocated for the construction of levee banks along the existing Donald Walking Track in Byrne Street and for the extension of the existing levee bank at the Goodwin Village.

· Rationalisation of the community support program which requires youth and economic development to target government funded programs. This will maximise Council’s ability to secure funding to the community from external sources and minimise the cost to our community.

· Rationalisation of the Customer Service provision by increasing access for all financial transactions at Post Office outlets and closing the public access at four of Council’s District Offices.

· Improvement to Community Halls with a range of upgrade works to kitchens, heating and cooling. Council will also improve the community access to our Halls by removing the fees charged to community groups.

· Injection of $214,000 into support for recreation reserves across the Shire. This will provide Recreation Maintenance Allocations to 9 townships, provided direct to the local communities.

· Continued development and improvements to Council’s 7 swimming pools, with an additional $106,000 of funding for upgrade works.

· Rationalisation of our work crews with a reduction in grader fleet from 6 to 4 combined with a program to upgrade and modernise Council’s outdoor plant fleet.

· Continued renewal of our road network with over $1.35mill investment in reseals and resheets on roads across the Shire.

· Implementation of the Street Light Sustainability Upgrade program which will see Council’s street lights converted to LED technology. This will not only reduce Council’s carbon footprint but will see a long term cost saving to the community.

· Continued support of Council’s saleyards with a program to upgrade ramps and improvements to fencing.

· Rationalisation of our community grants program to reduce the administrative burden on local community groups. Community groups will now be directly funded from the budget, removing the need for an extensive administrative process. The program includes support for Senior Citizens’ Christmas Lunches and administrative support to Township Forums.

· Council will continue to support the Loddon Murray Leadership Program which provides an avenue for emerging community leaders to access a valuable opportunity to develop skills that can be injected back into the local area.

Cr Reid Mather

Mayor

Buloke Shire Council Special Meeting Wednesday, 25 June 2014

5.1.1 Adoption of Budget for Municipal Year Ending 30 June 2015

Attachment 1 Draft 2014-15 Budget for Adoption

Chief Executive Officer’s summary

Council has prepared a Budget for the 2014/15 financial year which seeks to balance the demand for services and infrastructure with the need to secure the long term financial sustainability for Council. Key budget information is provided below about the rate increase, operating result, services, cash and investments, capital works, financial position, financial sustainability and strategic objectives of the Council.

1. Rates

A = Actual F = Forecast B = Budget SRP = Strategic Resource Plan estimates

It is proposed that general rates increase by 6.0% for the 2014/15 year, raising total rates and charges of $11.45 million. This rate increase is in line with the level foreshadowed in Council’s Strategic Resource Plan adopted in the previous year. (The rate increase for the 2013/14 year was 6.0%)

2. Operating result

The expected operating result for the 2014/15 year is a surplus of $0.9 million, which is a decrease over 2013/14. The 2013/14 result was significantly impacted by flood recovery grants. The adjusted underlying result, which excludes items such as non-recurrent capital grants and non-cash contributions is a deficit of $5.1million, which is an improved position over 2013/14 Budget from a deficit of $9.1million – refer to point 6 of this summary for further information.

3. Cash position

Council’s cash position is budgeted to increase by $4.1 million resulting in a positive cash position at 30 June 2015 of $0.01 million. This is due to the $7 million loan provided for in the 2014/15 budget and reduction in capital spend. The improvement in the cash position is expected to improve over time thus providing funds for future works and services and repayment of loan borrowings.

4. Capital works

The capital works program for the 2014/15 year is expected to be $7.78 million of which $1.88 million relates to projects which will be carried forward from the 2013/14 year. The carried forward component is fully funded from the 2013/14 budget. Of the $7.8 million of capital funding required, $6.1 million will come from external grants with the balance from Council cash. The capital expenditure program has reduced to reflect the funds available from operating activities and relies heavily on grant funding in the medium term.

Asset renewal forms over 55% of the capital program, with investment in new assets being significantly influenced by development of flood related infrastructure ($1.65 million).

5. Financial position (working capital)

The financial position is expected to improve with net assets (net worth) to increase by $0.95 million to $169.64 million. Net current assets (working capital) will improve by $7.40 million to negative $3.34 million as at 30 June 2015. This is mainly due to a large invoice for floodworks of $2.8 million forecast to be paid in July, reducing Current Liabilities, combined with the effects of the new $7 million loan facility allowing cash holdings to finish at a positive $0.01 million.

6. Financial sustainability (adjusted underlying result)

A high level Strategic Resource Plan for the years 2014/15 to 2017/18 has been developed to assist Council in adopting a budget within a longer term prudent financial framework. The key objective of the Plan is financial sustainability in the medium to long term. The adjusted underlying result, which is a measure of financial sustainability, shows a decreasing deficit over the four year period.

John Hicks

Chief Executive Officer (Acting)

Buloke Shire Council Special Meeting Wednesday, 25 June 2014

5.1.1 Adoption of Budget for Municipal Year Ending 30 June 2015

Attachment 1 Draft 2014-15 Budget for Adoption

Budget processes

This section lists the budget processes to be undertaken in order to adopt the Budget in accordance with the Local Government Act 1989 (the Act) and Local Government (Planning and Reporting) Regulations 2014 (the Regulations).

Under the Act, Council is required to prepare and adopt an annual budget for each financial year. The budget is required to include certain information about the rates and charges that Council intends to levy as well as a range of other information required by the Regulations which support the Act.

The 2014/15 Budget, which is included in this report, is for the year 1 July 2014 to 30 June 2015 and is prepared in accordance with the Act and Regulations. The Budget includes financial statements being; a budgeted Comprehensive Income Statement, Balance Sheet, Statement of Changes in Equity, Statement of Cash Flows and Statement of Capital Works. These statements have been prepared for the year ended 30 June 2015 in accordance with the Act and Regulations, and consistent with the annual financial statements which are prepared in accordance with Australian Accounting Standards. The Budget also includes information about the rates and charges to be levied, the capital works program to be undertaken, the human resources required, and other financial information Council requires in order to make an informed decision about the adoption of the Budget.

In advance of preparing the Budget, Officers firstly review and update Council's long term financial projections. Financial projections for at least four years are ultimately included in Council's Strategic Resource Plan, which is the key medium-term financial plan produced by Council on a rolling basis. The preparation of the Budget, within this broader context, begins with Officers preparing the operating and capital components of the annual budget during January and February. A draft consolidated budget is then prepared and various iterations are considered by Council at informal briefings during March and April. A ‘proposed’ budget is prepared in accordance with the Act and submitted to Council in May for approval ’in principle’. Council is then required to give ’public notice’ that it intends to ’adopt’ the Budget. It must give 28 days notice of its intention to adopt the proposed budget and make the Budget available for inspection at its offices and on its internet web site. A person has a right to make a submission on any proposal contained in the budget and any submission must be considered before adoption of the budget by Council.

To assist interested persons to understand the Budget and make a submission if they wish, Council officers undertake a community engagement process including public information sessions, focus groups and other techniques. The final step is for Council to adopt the budget after receiving and considering any submissions from interested parties. The Budget is required to be adopted by 31 August 2014 and a copy submitted to the Minister within 28 days after adoption. The key dates for the 2014/15 Budget process are summarised below:

|

Budget process |

Timing |

|

1. Officers update Council's long term financial projections |

Dec/Jan |

|

2. Officers prepare operating and capital budgets |

Jan/Feb |

|

3. Councillors consider draft budgets at informal briefings |

Mar/Apr |

|

4. Proposed budget submitted to Council for approval |

May |

|

5. Public notice advising intention to adopt budget |

May |

|

6. Budget available for public inspection and comment |

May |

|

7. Public submission process undertaken |

May/Jun |

|

8. Submissions period closes (28 days) |

Jun |

|

9. Submissions considered by Council/Committee |

Jun |

|

10. Budget and submissions presented to Council for adoption |

Jun |

|

11. Copy of adopted budget submitted to the Minister |

Jun/Jul |

|

12. Revised budget where a material change has arisen |

Sep-Jun |

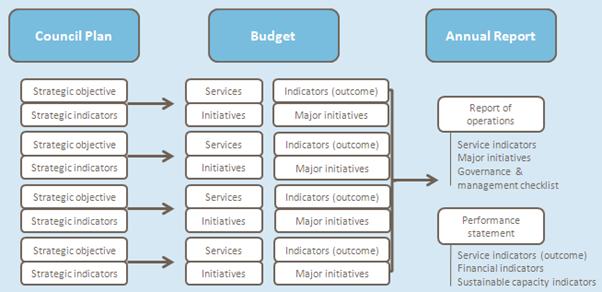

1. Linkage to the Council Plan

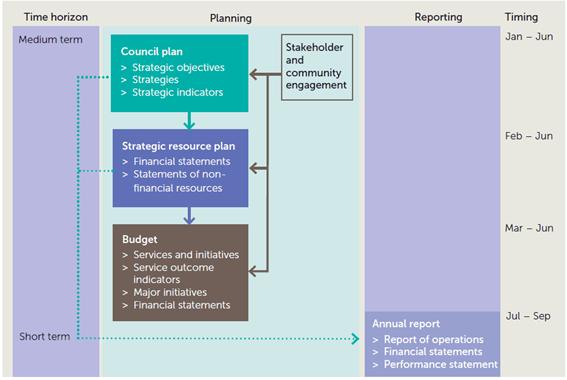

This section describes how the Annual Budget links to the achievement of the Council Plan within an overall planning framework. This framework guides the Council in identifying community needs and aspirations over the long term, medium term (Council Plan) and short term (Annual Budget) and then holding itself accountable (Audited Annual Statements).

1.1 Planning and accountability framework

The Strategic Resource Plan, included in the Council Plan, is a rolling four year plan that outlines the financial and non-financial resources that Council requires to achieve the strategic objectives described in the Council Plan. The Annual Budget is framed within the Strategic Resource Plan, taking into account the services and initiatives included in the Annual Budget which contribute to achieving the strategic objectives specified in the Council Plan. The diagram below depicts the planning and accountability framework that applies to local government in Victoria.

Source: Department of Transport, Planning and Local Infrastructure

The timing of each component of the planning framework is critical to the successful achievement of the planned outcomes. The Council Plan, including the Strategic Resource Plan, is required to be completed by 30 June following a general election and is reviewed each year in advance of the commencement of the Annual Budget process.

1.2 Our purpose

Our Vision:

Our vision is a sustainable community where everyone participates to enrich the cultural, social and economic viability of the Shire and cares for the natural environment.

Our mission

Our mission is to ensure the community has the practical tools to make Buloke an amazing place to live. We do this by:

· Providing a range of needed services.

· Engaging with the community to understand emerging needs.

· Advocating on behalf of the community for services to meet needs.

· Good governance and sound financial and risk management practices.

· Involving the community in making decisions that affect them directly and indirectly.

· Celebrating community achievements and milestones together.

Our values

Accountability for the Future

Creating the Future

Financial Sustainability

Asset-Based Approaches

Interconnected and Interdependent

Always Practical

Service Principles

1.3 Strategic objectives

Council delivers services and initiatives under 24 major service categories. Each contributes to the achievement of one of the five Strategic Objectives as set out in the Council Plan for the years 2013-17. The following table lists the five Strategic Objectives as described in the Council Plan.

|

Strategic Objective |

Description |

|

1. Our Community |

A Buloke community where people of all ages, backgrounds and abilities are embraced and supported and can access the Council services they need to live healthy and fulfilling lives. A Buloke community connected and involved in shaping decisions that affect them. |

|

2. Our Local Economy |

A local economy in which the contribution of the agricultural sector and business sector is recognised and their continued growth actively encouraged and supported. A local economy in which new business is actively encouraged; investment welcomed; employment created; business skills developed and local networks are supported. |

|

3. Our Built Environment |

A Shire planned to meet the current and future needs of the agricultural sector while maintaining and enhancing its natural environment. A Shire where roads, drains, public spaces, community facilities, parks and other essential infrastructure are fit for purpose, well maintained and contribute to the well-being of the community. |

|

Strategic Objective |

Description |

|

4. Our Natural Environment |

A Shire working with the community to reduce our carbon footprint, protect and enhance the natural environment and share experiences and information. |

|

5. Our People and Organisation |

An organisation that is responsive to the evolving needs of the community. An organisation that is responsibly governed with a strong emphasis on sustainable financial and risk management. An organisation that values and supports the development of its people and is an employer of choice. An organisation committed to active communication and engagement with our community. |

2. Services, initiatives and service performance indicators

This section provides a description of the services and initiatives to be funded in the Budget for the 2014/15 year and how these will contribute to achieving the strategic objectives specified in the Council Plan as set out in Section 1. It also includes a number of initiatives, and service performance outcome indicators. The Strategic Resource Plan (SRP) is part of and prepared in conjunction with the Council Plan. The relationship between these components of the Budget and the Council Plan, along with the link to reporting in the Annual Report, is shown below.

Source: Department of Transport, Planning and Local Infrastructure

2.1 Strategic Objective 1: Our Community

To achieve our objective of Our Community, we will continue to plan, deliver and improve high quality, cost effective, accessible and responsive services. The services, initiatives, major initiatives and service performance indicators for each business area are described below.

Services

|

Service area |

Description of services provided |

Expenditure Net Cost |

|

Aged and Disability Services1)2) |

This service provides a range of maintenance and

support services to assist frail older people and younger people with a

disability to live independently at home. Council's service provides domestic

assistance, personal care, respite care, home maintenance, meals services,

volunteer coordination, aged transport, aged accommodation and senior

citizens centres. |

1,763 (1,161) 602 |

|

Early Years |

This service is to advocate for the wellbeing of

children and their families and ensure it is supported through planning and

service development. The service provides pre-school services in 5 towns,

maternal and child health and support for playgroups run by parents. |

351 (185) 166 |

|

Library Services |

This service provides mobile library services to the townships of Birchip (co-located with Birchip school), Charlton, Donald, Watchem, Berriwillock, Sea Lake, Culgoa, Nullawil and Wycheproof. |

278 (98) 180 |

|

Recreation,3) |

This service provides recreational facilities and support to community run recreation reserves in 9 towns across the Shire, as well as governance support to community recreation clubs and committees. |

315 (0) 315 |

|

Community Grants4) |

This service provides donations, allocations and support to groups in the community that contribute to services that connect and involve the local area. |

73 (0) 73 |

|

Environmental Health |

This

service promotes the health and well-being of the Shire’s local communities

through a range of Public Health Programs including immunisations, food

surveillance and registration of food premises, accommodation standards and

waste water management. |

149 (30) 119 |

Initiatives

1) The cost of Aged and Disability Services are to be capped to current levels with service delivery efficiencies implemented over the 2014/15 financial year. The service efficiencies will deliver a total saving of $150,000 in the 2015/16 financial year and beyond.

2) The current community transport services, which include the taxi subsidy in Wycheproof, volunteer transport and community bus will not be continued when the vehicles are no longer fit for purpose. This will result in $30,000 budget savings in 2015/16.

3) Council will contribute $214,000 into support for recreation reserves across the shire. This will provide Recreation Maintenance Allocations to 9 townships, provided directly to the local communities.

4) Rationalisation of Council’s community grants

program will reduce the administrative burden on local community groups.

Community groups will now be directly funded from the budget. The following

allocations are included in the budget:

|

Buy Local Christmas Promotion |

$3,500 |

|

Senior Citizens’ Christmas Functions |

$3,500 |

|

School Award Nights |

$850 |

|

Township Forum Administrative Support |

$10,000 |

|

Event Sponsorships |

$6,300 |

|

Community Grants Program |

$20,000 |

|

SES Contribution |

$6,500 |

|

Agricultural Shows |

$300 |

|

Australia Day Celebrations |

$5,000 |

|

L2P Funding Charlton College |

$15,000 |

|

Friends of Mt Wycheproof allocation |

$2,000 |

Service Performance Outcome Indicators

|

Service |

Indicator |

Performance Measure |

Computation |

|

Home and Community Care |

Participation

|

Participation in HACC service (Percentage of the municipal target population who receive a HACC service)

|

[Number of people that received a HACC service / Municipal target population for HACC services] x100

|

|

|

|

Participation in HACC service by CALD people (Percentage of the municipal target population in relation to CALD people who receive a HACC service)

|

[Number of CALD people who receive a HACC service / Municipal target population in relation to CALD people for HACC services] x100

|

|

Early Years |

Participation |

Participation in the MCH service (Percentage of children enrolled who participate in the MCH service)

|

[Number of children who attend the MCH service at least once (in the year) / Number of children enrolled in the MCH service] x100

|

|

|

|

Participation in MCH service by Aboriginal children (Percentage of Aboriginal children enrolled who participate in the MCH service)

|

[Number of Aboriginal children who attend the MCH service at least once (in the year) / Number of Aboriginal children enrolled in the MCH service] x100

|

|

Libraries |

Participation |

Active library members (Percentage of the municipal population that are active library members)

|

[Number of active library members / municipal population] x100

|

|

Service |

Indicator |

Performance Measure |

Computation |

|

Food safety

|

Health and Safety |

Critical and major non-compliance notifications (Percentage of critical and major non-compliance notifications that are followed up by Council) |

[Number of critical non-compliance notifications and major non-compliance notifications about a food premises followed up / Number of critical non-compliance notifications and major non-compliance notifications about food premises] x100

|

2.2 Strategic Objective 2: Our Local Economy

To achieve our objective of Our Local Economy, we will continue to plan, deliver and improve high quality, cost effective, accessible and responsive services. The services, initiatives, major initiatives and service performance indicators for each business area are described below.

Services

|

Service area |

Description of services provided |

Expenditure Net Cost |

|

Community Support5) |

The service develops links between and within the communities in the Shire and works with local communities and groups to access community projects recognised as community priorities and provides a range of youth services that support young people aged between 12 and 25. The service also facilitates economic development throughout the Shire and provides support to local businesses and assists in the promotion of tourism.

|

541 (105) 436 |

|

Saleyards,6) |

This service provides for the management and administration of the Council’s Saleyards Precinct at Wycheproof for external Livestock Agents to sell Livestock. |

98 (95) 3 |

|

Corporate Support7) |

This service provides donations, allocations and support to groups that will assists council to facilitate an environment that is conducive to a sustainable and growing local business sector and provides opportunities for local residents to improve their skill levels and access employment.

|

65 (0) 65 |

Initiatives

5) Council’s Community Services has previously been partly funded from drought and flood recovery funding and from the Uniting Church. These funding sources are no longer available. Rationalisation of the Community Support Program, which includes youth and economic development, to Council funding of 1.5 EFT is aimed at targeting government funded programs. This will maximise Council’s ability to secure funding to the community from external sources and minimise the cost to our community. Budget savings in the 2014/15 year are $90,000 with further savings projected in 2015/16 of $230,000.

6) Council’s Capital Budget will include upgrades of the ramps and fencing at the saleyards to ensure continued compliance with safety requirements.

7) The Budget provides for corporate support for

organisations which will enhance economic opportunities and advocate for

community issues. The following allocations are provided for in the budget:

|

Birchip Cropping Group |

$5,000 |

|

Buloke &Northern Grampians Landcare network |

$5,000 |

|

Regional Strategic Plan Stakeholder Contribution |

$1,500 |

|

Wimmera Mallee Tourism |

$5,000 |

|

Rural Councils Victoria |

$2,000 |

|

Municipal Association of Victoria |

$10,000 |

|

STEP Asset Management |

$8,000 |

|

Wimmera Regional Transport Group |

$5,200 |

|

Sunraysia Hwy Committee |

$1,000 |

|

Central Victorian Greenhouse Alliance |

$1,100 |

|

Livestock Saleyards Victoria Association |

$1,200 |

|

Alliance of Councils for Freight Development |

$2,000 |

|

Rate Free Program (phase out) |

$4,000 |

|

Loddon Murray Leadership Program |

$7,000 |

|

Central Murray Regional Transport Forum |

$3,000 |

Service Performance Outcome Indicators

|

Service |

Indicator |

Performance Measure |

Computation |

|

Economic Development

|

Economic activity |

Change in number of businesses (Percentage change in the number of businesses with an ABN in the municipality)

|

[Number of businesses with an ABN in the municipality at the end of the financial year less the number of businesses at the start of the financial year / Number of businesses with an ABN in the municipality at the start of the financial year] x100

|

2.3 Strategic Objective 3: Our Built Environment

To achieve our objective of Our Built Environment, we will continue to plan, deliver and improve high quality, cost effective, accessible and responsive services. The services, initiatives, major initiatives and service performance indicators for each business area are described below.

Services

|

Service area |

Description of services provided |

Expenditure Net Cost |

|

Assets & Project Management |

This service is to provide for the management, design and administration of Council's assets and infrastructure services, including planning and management of the capital works program.

|

160 (50) 110 |

|

Property Maintenance8) |

This service is to provide Property Maintenance Services to a range of Council's building-based assets, focussing on the upkeep and renewal of buildings. |

999 (47) 952 |

|

Road Services9)10) |

This service is to provide road maintenance for the 1100km of Sealed, 650km of Gravel and 3,800km of Earth roads across the Shire. |

8,194 (2,233) 5,961 |

|

Swimming Pools11) |

This service manages and operates seven seasonal swimming pools, from the third week in November to the third week in March, annually. |

676 (0) 676 |

|

Urban Areas12) |

This service manages and coordinates Council’s Parks

& Gardens, Urban Infrastructure & Aerodromes providing routine,

preventative and on-going maintenance and improvements. |

2,755 (3) 2,752 |

|

Statutory Compliance13) |

The purpose of the Statutory and Compliance Service is to provide Statutory Planning, Building Services and Compliance and Local Laws services. |

683 (224) 459 |

Initiatives

8) Improvement to Community Halls with a range of upgrade works to kitchens, heating and cooling. Council will also improve the community access to our Halls by removing the fees charged to community groups.

9) Rationalisation of our work crews with a reduction in grader crews from 6 to 4 combined with a program to upgrade and modernise Council’s outdoor plant fleet. This will be phased in over the 2014/15 financial year with budget savings in the 2015/16 year projected to be $970,000.

10) The Budget provides for the implementation of Council’s Road Management Plan which, with new road classifications, reduces Council’s long term costs and the roads depreciation reduction of $556,000.

11) Continued delivery of seasonal swimming pools in 7 townships. Council to seek further partnerships with community groups to increase the accessibility to community pools.

12) Rationalisation of resources in Urban Areas in Environment will be phased in over the 2014/15 financial year resulting in a 25% reduction in resource levels, delivering a budget saving in 2015/16 of $270,000.

13) Develop a Rural Land Use Strategy for the Buloke Planning Scheme that will plan for long term agricultural productivity alongside complimentary uses within rural zones.

Service Performance Outcome Indicators

|

Service |

Indicator |

Performance Measure |

Computation |

|

Aquatic Facilities

|

Utilisation

|

Utilisation of aquatic facilities (Number of visits to aquatic facilities per head of municipal population)

|

Number of visits to aquatic facilities / Municipal population |

|

Statutory planning |

Decision making |

Council planning decisions upheld at VCAT (Percentage of planning application decisions subject to review by VCAT and that were not set aside) |

[Number of VCAT decisions that did not set aside Council’s decision in relation to a planning application / Number of VCAT decisions in relation to planning applications] x100

|

|

Roads

|

Satisfaction

|

Satisfaction with sealed local roads (Community satisfaction rating out of 100 with how Council has performed on the condition of sealed local roads)

|

Community satisfaction rating out of 100 with how Council has performed on the condition of sealed local roads

|

|

Animal Management

|

Health and safety

|

Animal management prosecutions (Number of successful animal management prosecutions) |

Number of successful animal management prosecutions

|

2.4 Strategic Objective 4: Our Natural Environment

To achieve our objective of Our Natural Environment, we will continue to plan, deliver and improve high quality, cost effective, accessible and responsive services. The services, initiatives, major initiatives and service performance indicators for each business area are described below.

Services

|

Service areas |

Description of services provided |

Expenditure Net Cost |

|

Environmental Planning14)15) |

This service manages Council's Environmental Compliance and Sustainability Programs and Services. |

95 (0) 95 |

|

Lakes16) |

This service provides a contribution to the management and development of the Recreational Lakes including Tchum, Green, Wooroonook, Watchem & Folletti Lakes. |

42 (0) 42 |

|

Waste & Environment17) |

Waste and Environment Services is responsible for the maintenance and improvement of Council’s landfills and transfer stations as well as providing a Residential Kerbside Garbage & Recycling service in all towns within the Shire. |

1,416 (1,043) 373 |

Initiatives

14) Implementation of the Street Light Sustainability Upgrade program which will see Council’s street light converted to LED technology. This will not only reduce Council’s carbon footprint but will see a long term cost saving to the community.

15) A review of all Council owned and/or operated gravel pits will be commenced in 2014/15 to ascertain the future planning and operation of these assets.

16) Council will continue to support lakes with cleaning and litter collection. Contribution to water costs will not be included for funding in the 2014/15 budget; however GWM Water will take over subsidising local lake committees of the water cost by over 50% through the new Recreation Contribution Charge. This has reduced the cost of water delivered to lakes from $48 per megalitre to $20 per megalitre.

17) Council will provide for full cost recovery for waste management and street cleaning services, resulting in an improved budget position for 2014/15 of $431,000.

Service Performance Outcome Indicators

|

Service |

Indicator |

Performance Measure |

Computation |

|

Waste collection

|

Waste diversion

|

Kerbside collection waste diverted from landfill (Percentage of garbage, recyclables and green organics collected from kerbside bins that is diverted from landfill)

|

[Weight of recyclables and green organics collected from kerbside bins / Weight of garbage, recyclables and green organics collected from kerbside bins] x100

|

2.5 Strategic Objective 5: Our People and Organisation

To achieve our objective of Our People and Organisiation, we will continue to plan, deliver and improve high quality, cost effective, accessible and responsive services. The services, initiatives, and service performance indicators for each business area are described below.

Services

|

Service areas |

Description of services provided |

Expenditure Net Cost |

|

Customer Services18) |

This service provides for both internal and external customers by resolving the majority of customer enquiries, requests and payments at the first point of contact. |

471 (0) 471 |

|

Governance & Executive Management |

This service provides for Councillors, and Executive Support and associated which provides the overall Governance Services to the Council.

|

897 (0) 897 |

|

Information Management |

This service is to provide the organisation with Records Management Services and Information and Telecommunications Services.

|

1,030 (0) 1,030 |

|

Municipal Emergency Management19) |

This service develops, coordinates and delivers Council’s Municipal Emergency Management Plan and coordination of MECC Centre and associated software.

|

159 (60) 99 |

|

Procurement.20) |

This service reviews and implements all business processes associated with purchasing, contracting and the tendering services and to manage Council's light fleet and community buses.

|

393 (10) 383 |

Initiatives

18) Rationalisation of the Customer Service provision by increasing access for all financial transactions at Post Office outlets and closing the public access at four of Council’s District Offices. This initiative is to be phased in over the 2014/15 financial year resulting in budget savings of $380,000 in the 2015/16 budget.

19) In collaboration with emergency services agencies, Council will complete a full review and implementation of a new Municipal Emergency Management Plan and commence reviews on emergency sub-plans.

20) Improved efficiencies in the provision of procurement services to provide the service with 2.5EFT. This initiative will be phased in over the 2014/15 financial year resulting in budget savings in 2014/15 of $70,000 and total saving in the 2015/16 Budget of $150,000.

|

Service |

Indicator |

Performance Measure |

Computation |

|

Governance

|

Satisfaction |

Satisfaction with Council decisions (Community satisfaction rating out of 100 with how Council has performed in making decisions in the interests of the community)

|

Community satisfaction rating out of 100 with how Council has performed in making decisions in the interests of the community

|

2.6 Performance Statement

The service performance indicators detailed in the preceding pages will be reported on within the Performance Statement which is prepared at the end of the year as required by section 132 of the Act and included in the 2014/15 Annual Report. The Performance Statement will also include reporting on prescribed indicators of financial performance (outlined in section 8) and sustainable capacity, which are not included in this budget report. The full set of prescribed performance indicators are audited each year by the Victorian Auditor General who issues an audit opinion on the Performance Statement. The major initiatives detailed in the preceding pages will be reported in the Annual Report in the form of a statement of progress in the report of operations.

Buloke Shire Council Special Meeting Wednesday, 25 June 2014

5.1.1 Adoption of Budget for Municipal Year Ending 30 June 2015

Attachment 1 Draft 2014-15 Budget for Adoption

3. Budget influences

This section sets out the key budget influences arising from the internal and external environment within which the Council operates.

3.1 Snapshot of Buloke Shire Council

Our Shire

Buloke Shire is located in north-western Victoria, between 210 and 360 kilometres north-west of Melbourne and is bounded by Mildura and Swan Hill Rural Cities in the north, Gannawarra and Loddon Shire in the east, Northern Grampians Shire in the south, and Yarriambiack Shire in the west.

Buloke is a predominantly rural area used largely for agriculture, particularly grain (wheat, oats and barley) production and sheep grazing. The main townships are Birchip, Charlton, Donald, Sea Lake and Wycheproof. Smaller townships include Berriwillock, Culgoa, Nandaly, Nullawil and Watchem.

The Shire encompasses a total land area of approximately 8,000 square kilometres. It is approximately 140 kilometres long and 60 kilometres wide.

Our Community

6,388 people live in 3,282 households in Buloke, making it one of Victoria’s most sparsely populated municipalities. The community of Buloke is made up of 2,035 (31.9%) of people over the age of 60; 2,900 (45.4%) between 18 and 60 years; 1,119 (14.2%) between 5 and 17 years; and 334 (5.3%) between 0 and 4 years.

The Buloke population is stable, with 4,238 residents (66.3%) living in the Shire for at least five years. 652 residents (10.2%) moved to the Shire from another part of Victoria in the five years prior to 2011. 210 residents (3.3%) moved to the Shire from another part of Australia in the five years to 2011.

The educational qualifications attained by Buloke residents are comparatively less than found in regional Victoria with only 1,703 residents (32.6%) holding postsecondary educational qualifications.

Compared to regional Victoria, in 2011 there was a smaller proportion of high-income households (those earning $1,500 per week or more) and a larger proportion of low-income households (those earning less than $600 per week) in Buloke. Overall, 221 Buloke households (8.3%) earned a high income, and 408 (15.4%) were low-income households, compared with 10.3% and 12.3% respectively for regional Victoria.

Our Local Economy

Workplaces in Buloke provide approximately 2,725 jobs.

Agriculture is the most substantial employment sector in the Shire, providing 818 jobs (30.0%). This is followed by 319 jobs (11.7%) in the health sector, 227 (8.3%) in the education sector, 214 (7.9%) in the retail trades sector and 155 (5.7%) in the public administration sector. A small number of people work in the manufacturing sector (130 or 4.8%) and the construction sector (149 or 5.5%).

Between 2006 and 2011 the proportion of persons working in the agriculture sector, retail, manufacturing and education sectors all fell. The number of persons who reported working in the agriculture sector fell by 15% (140 jobs over the five-year period). Jobs in the retail sector fell 15% with falls of 6% and 3% respectively in the manufacturing and education sectors. Increases were reported in the transport and technical sectors, but the numbers were small.

Volunteering is an important part of the Buloke economy and is an accepted indicator of community cohesiveness and wellbeing, and of how readily individuals are able to contribute to their community. Analysis of the voluntary work performed in Buloke in 2011 compared to regional Victoria shows that there was a higher proportion of persons participating in volunteer activities in Buloke than in the average of other rural municipalities.

Drivers of Change

Increased agricultural productivity

Increased agricultural productivity and the emergence of larger farms across the Shire have resulted in fewer farms and less demand for workers, leading to population loss. This process has been particularly pronounced in recent years and current trends suggest it will continue in the future.

Between 2001 and 2011, the number of farms in the Shire fell from over 710 to under 554.

Population decline

The general trend across dry land farming areas in Victoria is that towns between one and two thousand people are experiencing continuing population decline due to job losses in agriculture and other sectors where services have been withdrawn, such as banking, government administration and education. As commented earlier this is likely to continue into the future.

A changing climate

Water availability is a major driver of economic growth, environmental health and liveability in Buloke. Over the next 20 to 50 years climate change is predicted to result in higher average temperatures, lower average rainfall, greater intensity of rainfall, and potentially an increase in the frequency of droughts.

Global food demand

The expected increase in global food demand will provide opportunities for food producing regions that can successfully adapt to climate change and other factors affecting agriculture, such as energy costs, volatile international commodity markets, varying currency valuations and the impact of new markets in emerging regions for high quality products.

Liveability factors

Various factors influence people’s choices on where to live include availability of employment, choice and affordability of housing, education, health, cultural, family proximity and lifestyle features.

Employment is likely to continue to be the single largest factor impacting on choice to locate in Buloke.

Migration

Another population trend in rural Victoria has been the outward migration of young people to regional centres and metropolitan Melbourne for education and employment opportunities and the inward migration of people in the 50 to 64 age bracket.

In Buloke there has been a consistent net outward migration of young people to Melbourne or larger regional centres such as Bendigo, Ballarat and Mildura for education and employment over the past 30 years.

Accompanying this loss of younger residents, for the majority of the period since 1981 there has been a net inward migration of residents in the 50 to 64 age bracket. This inward migration has been for liveability and affordability reasons.

Both of these trends are expected to continue into the future.

Budget implications

As a result of the Shire’s demographic profile there are a number of budget implications in the short and long term:

· Population decline will result in the rate burden being borne by a smaller rate base. This has resulted in a requirement to review service levels and reduce the operating expenditure of the council. This will see an overall reduction in staff numbers in the 2014/15 and 2015/16 financial years.

· The Shire’s reliance on community volunteers has seen the budget retain funding levels to areas of the community which rely on volunteer services.

3.2 External influences

· Consumer Price Index (CPI) increases on goods and services of 2.7% through the year to December quarter 2013 (ABS release 22 January 2014 State-wide CPI is forecast to be 2.5% for the 2014/15 year (Victorian Budget Papers 2013/14).

· Australian Average Weekly Earnings (AWE) growth for Public Sector full-time adult ordinary time earnings in the 12 months to May 2013 was 4.5% (ABS release 15 August 2013). The wages price index in Victoria is projected to be 3.5% per annum in 2014/15 and the subsequent two years (Victorian Budget Papers 2013/14). Council must renegotiate a new Collective Agreement during the 2014/15 year. Completion of the substantial Flood Recovery works will see a significant reduction in external grant funds.

· The Abbott Government introduced the Clean Energy Legislation (Carbon Tax Repeal) Bill 2013 and related bills to the House of Representatives on the 13th of November 2013, with the intention to abolish the carbon price from 1 July 2014.

· The Fire Services Property Levy will continue to be collected by Council on behalf of the State Government with the introduction of the Fire Services Property Levy Act 2012.

3.3 Internal influences

As well as external influences, there are also a number of internal influences which are expected to have a significant impact on the preparation of the 2014/15 Budget. These matters have arisen from events occurring in the 2013/14 year resulting in variances between the forecast actual and budgeted results for that year and matters expected to arise in the 2014/15 year. These matters and their financial impact are set out below:

· The funding partnership from the Uniting Church for Youth services has ended. This will result in a rationalisation of our Youth, Economic Development and Community Services.

· A review of Waste Services has identified a significant shortfall in income from users of the service. The budget makes provision for full cost recovery for Council’s garbage charge.

3.4 Budget principles

In response to these influences, guidelines were prepared and distributed to all Council officers with budget responsibilities. The guidelines set out the key budget principles upon which the officers were to prepare their budgets. The principles included:

· Existing fees and charges to be increased in line with CPI or market levels.

· Grants to be based on confirmed funding levels.

· New revenue sources to be identified where possible.

· Salaries and wages to be increased in line with EBA arrangements.

· Real savings in operating expenditure to be implemented over the 2014/15 and 2015/16 financial year.

· Construction and material costs to increase in line with the Engineering Construction Index.

· Operating revenues and expenses arising from completed 2013/14 capital projects to be included.

3.5 Long term strategies

The budget includes consideration of a number of long term strategies and contextual information to assist Council to prepare the Budget in a proper financial management context. These include a Strategic Resource Plan for 2014/15 to 2017/18 (section 8.), Rating Information (section 9.) and Other Long Term Strategies (section 10.) including borrowings and service reviews.

Buloke Shire Council Special Meeting Wednesday, 25 June 2014

5.1.1 Adoption of Budget for Municipal Year Ending 30 June 2015

Attachment 1 Draft 2014-15 Budget for Adoption

4. Analysis of operating budget

This section analyses the operating budget including expected income and expenses of the Council for the 2014/15 year.

4.1 Budgeted income statement

|

|

Ref |

Forecast Actual 2013/14 $’000 |

Budget 2014/15 $’000 |

Variance

$’000 |

|

Total income |

4.2 |

57,178 |

25,319 |

(31,859) |

|

Total expenses |

4.3 |

(25,411) |

(24,370) |

1,041 |

|

Surplus (deficit) for the year |

|

31,767 |

949 |

(30,818) |

|

Grants – capital non-recurrent |

4.2.6 |

(40,350) |

(4,969) |

35,381 |

|

Contributions - non-monetary assets |

|

0 |

0 |

0 |

|

Capital contributions - other sources |

4.2.4 |

(519) |

(1,120) |

(601) |

|

Adjusted underlying surplus (deficit) |

4.1.1 |

(9,102) |

(5,140) |

3,962 |

4.1.1 Adjusted underlying deficit ($3.96 million decrease)

The adjusted underlying result is the net surplus or deficit for the year adjusted for non-recurrent capital grants, non-monetary asset contributions, and capital contributions from other sources. It is a measure of financial sustainability and Council’s ability to achieve its service delivery objectives as it is not impacted by capital income items which can often mask the operating result. The adjusted underlying result for the 2014/15 year is a deficit of $5.14 million which is an improvement of $3.96 million from the 2013/14 year. In calculating the adjusted underlying result, Council has excluded grants received for capital purposes which are non-recurrent and capital contributions from other sources.

4.2 Income

|

Income Types |

Ref |

Forecast Actual 2013/14 $’000 |

Budget 2014/15 $’000 |

Variance

$’000 |

|

Rates and charges |

4.2.1 |

10,446 |

11,453 |

1,007 |

|

Statutory fees and fines |

4.2.2 |

86 |

84 |

(2) |

|

User fees |

4.2.3 |

709 |

744 |

35 |

|

Contributions - cash |

4.2.4 |

589 |

132 |

(457) |

|

Grants - operating |

4.2.5 |

3,945 |

6,665 |

2,720 |

|

Grants – capital |

4.2.6 |

40,350 |

5,969 |

(34,381) |

|

Net gain on sale of assets |

4.2.7 |

14 |

10 |

(4) |

|

Other income |

4.2.8 |

1,039 |

262 |

(777) |

|

Total income |

|

57,178 |

25,319 |

(31,859) |

4.2.1 Rates and charges ($1.01 million increase)

It is proposed that general rate income be increased by 6.0% over 2013/14 to $9.514 million. Kerbside waste and recycling charges are proposed to increase to $1.28 million (49% increase) to reflect full cost recovery. Section 9. “Rating Information” includes a more detailed analysis of the rates and charges to be levied for 2014/15. Information on rates and charges specifically required by the Regulations is included in Appendix B.

4.2.2 Statutory fees and fines ($0.02 million decrease)

Statutory fees relate mainly to fees and fines levied in accordance with legislation and include animal registrations. These form a minor part of council income stream.

A detailed listing of statutory fees is included in Appendix D.

4.2.3 User fees ($0.03 million increase)

User charges relate mainly to the recovery of service delivery costs through the charging of fees to users of Council’s services. These include, use community facilities and the provision of human services such as family day care and home help services. In setting the budget, the key principle for determining the level of user charges has been to ensure that increases do not exceed CPI increases or market levels.

A detailed listing of fees and charges is included in Appendix D.

4.2.4 Contributions - cash ($0.46 million decrease)

Contributions relate to monies paid by developers in accordance with planning permits issued for property development and by community groups for contributions to capital projects.

Contributions are projected to decrease by $0.46 million compared to 2013/14 due mainly to the completion of a number of community projects within the municipality during the 2013/14 year.

4.2.5 Grants - operating ($2.72 million increase)

Operating

grants include all monies received from State and Federal sources for the

purposes of funding the delivery of Council’s services to ratepayers. Overall,

the level of operating grants has increased by $2.72 million compared to 2013/14. The

increase in Victoria Grants Commission (VGC) funding, is related to the

adjusted timing of which we have been advised with regard to receiving the

funding.

A list of operating grants by type and source, classified into recurrent and non-recurrent, is included below.

|

Operating Grant Funding Types and Source |

Forecast Actual 2013/14 $’000 |

Budget 2014/15 $’000 |

Variance

$’000 |

|

Recurrent - Commonwealth Government |

|

|

|

|

Victorian Grants Commission |

2,679 |

5,469 |

2,790 |

|

Family day care |

|

|

|

|

General home care |

561 |

563 |

2 |

|

Other (*specify each type) |

|

|

|

|

Recurrent - State Government |

|

|

|

|

Primary care partnerships |

|

|

|

|

Aged care |

164 |

162 |

(2) |

|

School crossing supervisors |

12 |

12 |

0 |

|

Libraries |

99 |

98 |

(1) |

|

Maternal and child health |

135 |

130 |

(5) |

|

Recreation |

55 |

55 |

0 |

|

Community safety |

24 |

24 |

0 |

|

Other (*specify each type) |

67 |

102 |

35 |

|

Total recurrent grants |

3,796 |

6,615 |

2,819 |

|

|

|

|

|

|

Non-recurrent - Commonwealth Government |

|

|

|

|

Drainage maintenance |

|

- |

|

|

Environmental planning |

80 |

50 |

(30) |

|

Non-recurrent - State Government |

|

|

|

|

Community health |

69 |

0 |

(69) |

|

Family and children |

- |

|

|

|

Total non-recurrent grants |

149 |

50 |

(99) |

4.2.6 Grants - capital ($34.38 million decrease)

Capital grants include all

monies received from State, Federal and community sources for the purposes of

funding the capital works program. Overall the level of capital grants has

decreases by $35.39 million compared to 2013/14

due to the completion of flood works in

the previous year. Section 6. “Analysis of Capital Budget” includes a more

detailed analysis of the grants and contributions expected to be received

during the 2014/15 year.

A list of capital grants by type and source, classified into recurrent and

non-recurrent, is included below. Some of these grants are subject to funding

announcements.

|

Capital Grant Funding Types and Source |

Forecast Actual 2013/14 $’000 |

Budget 2014/15 $’000 |

Variance

$’000 |

|

Recurrent - Commonwealth Government |

|

|

|

|

Roads to recovery |

|

1,000 |

1,000 |

|

Recurrent - State Government |

- |

- |

- |

|

Country Roads and bridges |

1,000 |

1,000 |

0 |

|

Total recurrent grants |

1,000 |

2,000 |

1,000 |

|

Non-recurrent - Commonwealth Government |

|

|

|

|

Flood Grants |

37,900 |

700 |

(37,200) |

|

Buildings |

50 |

0 |

(50) |

|

Community Infrastructure |

539 |

581 |

42 |

|

Drainage |

|

1,558 |

1,558 |

|

Footpaths |

|

|

|

|

Non-recurrent - State Government |

|

|

|

|

Buildings |

861 |

1,130 |

259 |

|

Total non-recurrent grants |

39,350 |

3,969 |

(35,381) |

4.2.7 Net gain on sale of assets minor decrease)

Proceeds from the sale of Council assets are forecast to be $10,000 for 2014/15 which relates to the sale of minor plant.

4.2.8 Other income ($0.88 million decrease)

Other income relates to a range of items such as private works, cost recoups and other miscellaneous income items. It also includes interest revenue on investments and rate arrears.

Other income is forecast to decrease by $0.88 million compared to 2013/14. This is mainly due to the work that was carried out by council works crews on the Flood Contract which will not be available in 2013/14.

4.3 Expenses

|

Expense Types |

Ref |

Forecast Actual 2013/14 $’000 |

Budget 2014/15 $’000 |

Variance

$’000 |

|

Employee costs |

4.3.1 |

10,107 |

10,135 |

28 |

|

Materials and services |

4.3.2 |

6,583 |

5,785 |

(798) |

|

Bad and doubtful debts |

4.3.3 |

13 |

11 |

(2) |

|

Depreciation and amortisation |

4.3.4 |

7,707 |

7,334 |

(373) |

|

Finance costs |

4.3.5 |

127 |

376 |

249 |

|

Other expenses |

4.3.6 |

874 |

729 |

(145) |

|

Total expenses |

|

25,411 |

24,370 |

(1,041) |

Source: Appendix A

4.3.1 Employee costs ($.03 million increase)

Employee costs include all labour related expenditure such as wages and salaries and on-costs such as allowances, leave entitlements, employer superannuation, rostered days off, etc.

Employee costs are forecast to increase by $28,000 compared to 2013/14. Staff numbers are projected to decrease by 5 EFT from the 2013/14 budget with salary increases as per the Enterprise Agreement.

A summary of human resources expenditure categorised according to the organisational structure of Council is included below:

|

|

|

Comprises |

|

|

Department |

Budget 2014/15 $’000 |

Permanent Full time $’000 |

Permanent Part Time $’000 |

|

Asset & Infrastructure |

1,236 |

1,116 |

120 |

|

Community Services |

1,414 |

494 |

920 |

|

Corporate Services |

1,044 |

817 |

227 |

|

Finance & Governance |

2,032 |

1,881 |

151 |

|

Works & Construction |

3,881 |

3,558 |

323 |

|

Total permanent staff expenditure |

9,607 |

7,866 |

1,741 |

|

Casuals and other expenditure |

528 |

|

|

|

Total operating expenditure |

10,135 |

|

|

|

Capital expenditure |

235 |

|

|

|

Total expenditure |

10,370 |

|

|

A summary of the number of full time equivalent (FTE) Council staff in relation to the above expenditure is included below:

|

|

|

Comprises |

|

|

Department |

Budget FTE

|

Permanent Full time |

Permanent Part Time

|

|

Asset & Infrastructure |

15.5 |

14 |

1.5 |

|

Community Services |

19.2 |

6 |

13.2 |

|

Corporate Services |

12.4 |

10 |

2.4 |

|

Finance & Governance |

21.4 |

20 |

1.4 |

|

Works & Construction |

54.4 |

51 |

3.4 |

|

Total permanent operating staff |

126 |

104 |

22 |

|

Casuals and other |

7.6 |

|

|

|

Total Capital works staff |

3 |

3 |

|

|

Total staff |